Startup Investing: The New Trend in Alternative Assets

Onevest

APRIL 30, 2015

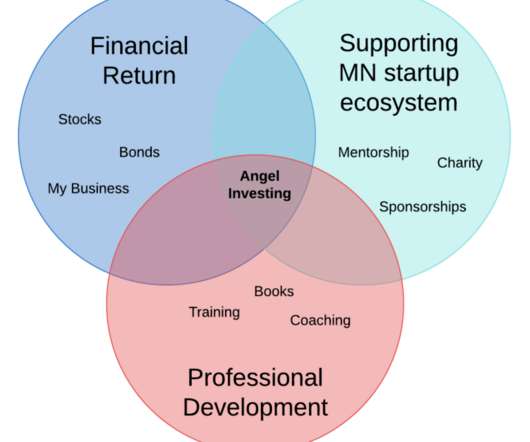

But the data shows a rapidly growing trend in accredited investors investing together. This is something that we have experience at 1000 Angels , the private investor network that connects startups with investors. This is in contrast to going it alone in direct investments or publicly traded REITs and stocks.

Let's personalize your content