Praying to the God of Valuation

Both Sides of the Table

DECEMBER 11, 2022

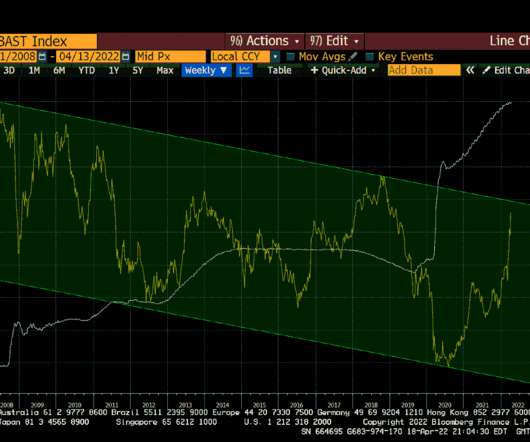

Between 2006–2008 I sold both companies that I had started and became a VC. SEEING THINGS FROM THE VC SIDE OF THE TABLE While I was a VC in 2007 & 2008 those were dead years because the market again evaporated due the the Global Financial Crisis (GFC). How’s that advice holding up? Hey, we got to raise again next year.

Let's personalize your content