Over 96% of new businesses fail in the first 10 years. But in some cases, like Groupon, startups cross the $1 billion mark in just their initial years.

Such growth isn’t new. Several startups, including Amazon and Facebook, saw their metrics shot up dramatically to form the shape of a hockey stick.

Today, disruption is rather slow-paced. Not every startup see such hockey stick growth. But, still, every startup, especially those seeking angel and venture capital funding, are conditioned to project this growth curve – because investors love it.

But what exactly is hockey stick growth and what makes it important for startups?

Let’s find out.

What Is Hockey Stick Growth?

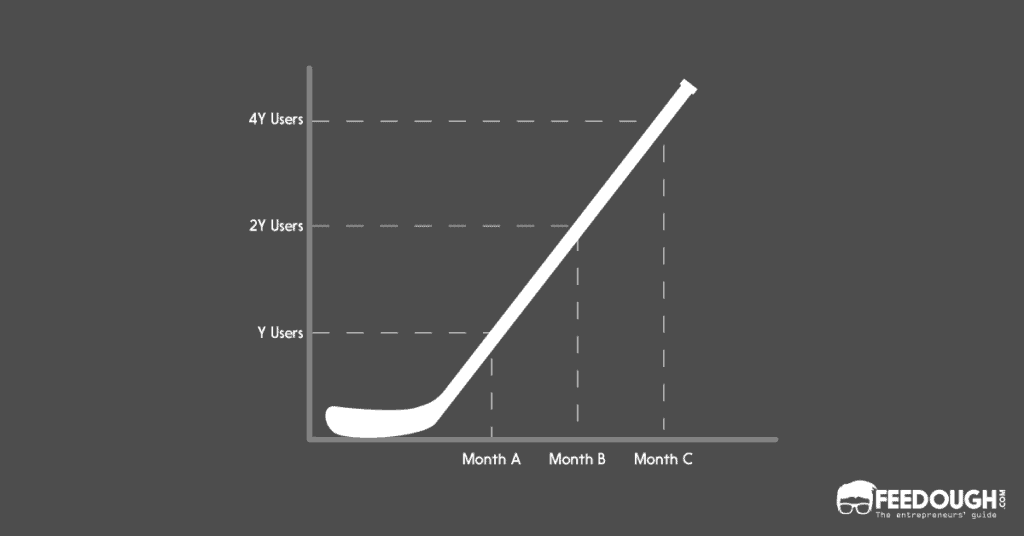

Hockey stick growth is the growth pattern that a company exhibits where initially there is a stagnant growth, but when a certain point is hit (point of inflexion), growth increases exponentially.

Usually, such growth charts differentiate a startup from a small business. Startups are known to disrupt the markets, and this disruption usually ends up in developing totally new demand for its offerings. Such demand and other metrics of a disruptive startup, when represented in the form of a graph, form a shape of a hockey stick.

Stages Of Hockey Stick Growth

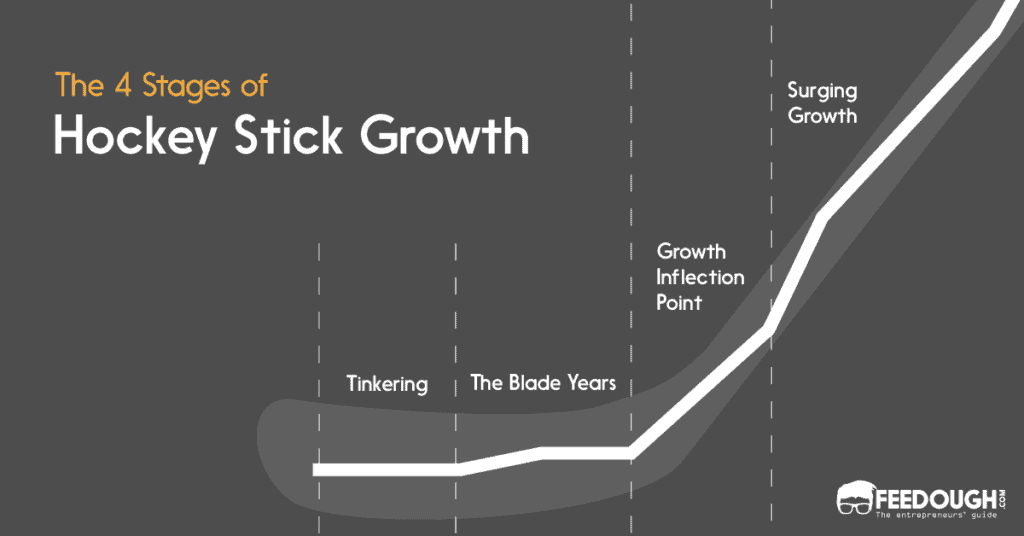

While launching a startup, every startup aims for a hockey stick growth. There are 4 main stages of growth which are observed while plotting the revenue growth of the companies.

Tinkering

This stage starts with the entrepreneurs analyzing and exploring the startup idea more seriously. They probe into the feasibility of the business idea and try to find the problem-solution-fit during this stage.

Tinkering ends when entrepreneurs fully commit themselves to turn the business idea into a reality.

Usually, founders haven’t quit their jobs at this stage.

Though this stage poses the least amount of pressure on an entrepreneur, some mistakes can still upend an innovative startup idea.

- Wasting time in building an elaborate business model

- Not discussing and showing actual sample products and seeking feedback for it in fear of competitors copying the idea.

At this stage, entrepreneurs’ primary focus should be on experimenting and developing the offering according to the feedback they get from their potential customers.

Blade Years

Blade years is the time period when the idea is validated in the market using early releases like MVP and beta version, and the final offering and its business model is being developed.

This is the phase where entrepreneurs quit their day job and commit themselves fully to the development of business.

Blade years usually last for 3 to 4 years, and the revenue generated is meagre. Usually, entrepreneurs use bootstrapping to finance their expenses.

Some of the common mistakes made at this stage are –

- As the entrepreneurs are hardly making any money to pay their personal bills, they devote a great deal of time and energy in making elaborate pitches for raising investment capital.

- Spending exorbitant amount of money on sales and marketing efforts such as expensive advertising campaigns and sales operations.

- Not being open to making further changes in the product.

Growth Inflection Point

This is the turning point when the business model is perfected. This is the point where the startup experiences an exponential increase in revenue.

At this stage, entrepreneurs may leverage their growth momentum to attract venture capitalists and other investors. This stage presents significant threats-

- As the business is scaling up too quickly, some startups can’t sustain the strong growth and eventually crash.

- To capitalize on this excellent growth opportunity, some entrepreneurs tend to make significant changes in a model that has been working reasonably well for them.

The primary focus should be on carefully assessing the operations and getting them in sync with the revenue growth.

Surging Growth

Once the startup is able to prove its potential and sustain this exponential growth during the growth-inflexion phase, its growth continues to accelerate at a fast pace, attracting more customers to try the offering.

During this phase, the entrepreneurs need to tackle the complexities of leading and managing the business that comes with an exploding market. At this stage, many large corporations make some very tempting offers to buy the company. The entrepreneurs are presented with 3 choices –

- Sell the company

- Remain the CEO

- Hire a CEO to manage the business

The entrepreneurs must make a smooth transition and hire top-quality managers to head the major departments instead of hiring unqualified people from their personal networks.

Examples Of Hockey Stick Growth

Some of the most obvious examples of hockey stick growth are-

Groupon

Founded in 2008, by Andre Mason and Eric Lefkofsky as an e-commerce marketplace, the revenue growth of Groupon stands as a perfect example for a hockey stick growth.

- Tinkering: The tinkering period lasted for almost 2 years from 2006 to 2008, where Andrew Mason first launched ‘The Point’ which eventually became Groupon. The revenue was around 10k during this time.

- Blade Years: This was a period of 2 years, where the revenue growth of Groupon was pretty much stagnant at around 14.5 million.

- Growth Inflection Point: Groupon hit the growth inflexion point in 2010 when its recorded revenue was around 313 million.

- Surging Growth: This period started in 2011, where Groupon crossed the 1 billion mark. This period represents the stick in the graph.

Netflix

Incorporated in 1997 by Reed Hastings as a DVD rental business, Netflix too witnessed a hockey stick growth during its initial years –

- Tinkering: The tinkering period was over 1 year from 1996 to 1997.

- Blade Years: The blade years lasted for at least 3 years from 1997 to 2000, where its revenue was around 1.5 million. It was during this period that Netflix stopped selling DVDs and launched subscription services.

- Growth Inflection point: Netflix hit its growth inflexion point in 2000 with its revenue at 41 million.

- Surging Growth: This period started in 2001. During this period, Netflix attained around 500,000 subscribers and also initiated an IPO for $15 per share.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on hockey stick growth in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

![How To Get Startup Funding [The Complete Guide] startup funding guide](https://www.feedough.com/wp-content/uploads/2022/08/startup-funding-guide.webp)