Last month, I published an analysis of venture deal activity in the United States during the COVID-19 pandemic, which demonstrated that despite early warnings of an impending collapse, the pace of venture deal activity in the first half of 2020 was more or less on par with 2019. I concluded that many early observers failed to appreciate the ability of venture capitalists to adjust to a virtual environment and some analysts undercounted real-time deal activity by failing to account for the systematic reporting lags in venture capital databases—as a result, they hastily drew conclusions that have not withstood the test of time. I demonstrated that with a few small adjustments, the real-time data pointed to a venture economy that wouldn’t miss a beat this year.

We now have fresh data to extend that analysis. It shows that after a slight dip in the second quarter, venture deal activity (adjusted for the systemic data lags) rebounded in the third quarter to a level that was about the same as the first quarter. In fact, through the first three quarters of the year, 2020 is on pace to be the most active year for venture deals since the Dotcom era peak in 2000.

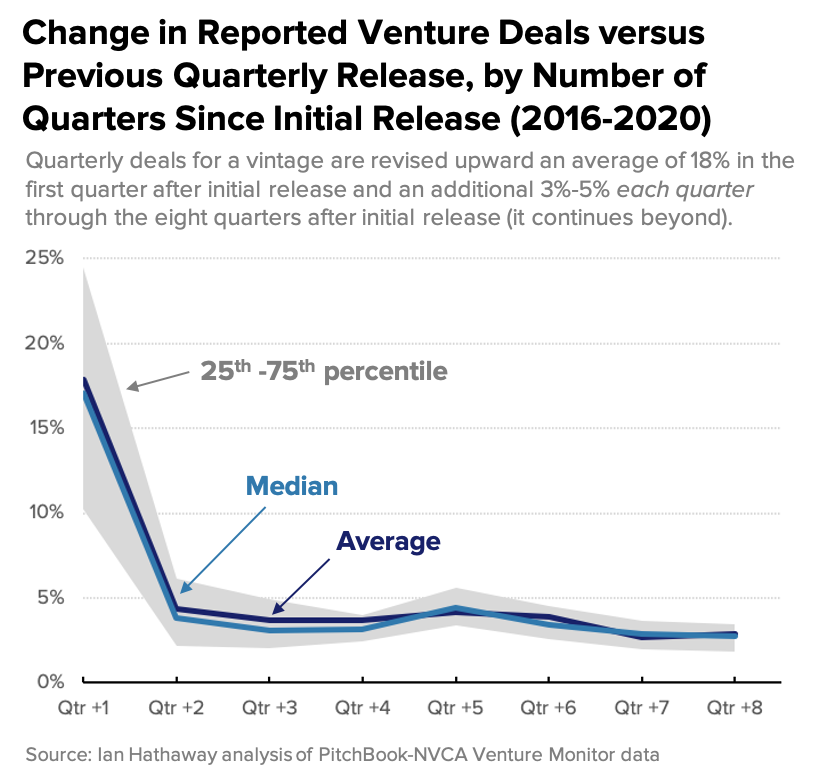

To demonstrate, I’ll present quarterly data on venture deal activity from the PitchBook-NVCA Venture Monitor (Q1-2016 - Q3-2020). The data are tabulated as a snapshot of the PitchBook database on the final day of the quarter, aggregated along dimensions of stage, sector, and others. As a dynamic database, new deals are constantly being added, however, these quarterly report provide a historical snapshot that can then be analyzed against future releases. With future releases, previously released data aggregates (deal counts) get revised upward. As I noted last month, the largest upward revisions occur in the quarter immediately following a quarterly vintage’s initial release.

The implication here is that quarter-to-quarter comparisons are most problematic in real time because reported deal counts for the most recent quarter are at their all-time lowest precisely at the time that the preceding quarter goes through its largest upward revision. This has the effect of overstating (understating) declines (increases) in quarter-to-quarter activity. Since the revisions are systematic, we are able to adjust real-time data releases based on these historical patterns, in order to provide a credible and timely estimate of the volume of venture activity.

To understand how the sector has evolved during the COVID-19 pandemic with the benefit of an additional quarter of data (and revisions), I present data for total quarterly venture deal activity as an aggregation of the three broad stage categories in the report: Angel/Seed, Early VC, and Later VC. For each quarter, I present the number of deals at initial release along with the number reported after the first revision (the subsequent quarter’s release). This allows for a more apples-to-apples comparison versus publishing a snapshot of the database today (where earlier values will be revised upward more than recent ones). Since the first revision is not available for the most recent quarter, Q3-2020, I will adjust it upward using the average (in percent) first revision for the previous four quarters. Data availability allows me to produce a consistent time series back to Q1-2016.

As the data show, deal activity rebounded in the third quarter after a slight dip in the second quarter. After an 8% quarter-to-quarter drop in the second quarter, third quarter deal activity increased 3% and was also 3% higher compared with the year prior (Q3-2019). The number of venture deals in Q3-2020 was just 2% lower than it was in the Q1-2020 and was greater than in 16 of the 18 quarters shown in the chart.

On that point, lag-adjusted deal activity through the first three quarters of this year was greater than venture deal activity in any of the other years shown. Zooming out, that indicates that 2020 is on pace to have more venture deals than any year since the peak of the Dotcom boom in 2000.

Overall venture deal activity has been steady during the COVID-19 pandemic so far, as entrepreneurs and venture capitalists found ways to make deals in a virtual environment. The story is of course more nuanced than that, with the mix of deals shifting toward later stage, with potentially greater challenges in securing new investments versus follow-on rounds, and with evolving deal structure and terms, to name a few. But the headline is the same: the venture economy has been resilient in the face of COVID-19 in 2020.